Aetna Emergency Room Deductible

Any services you receive must be covered under the terms of your aetna plan.

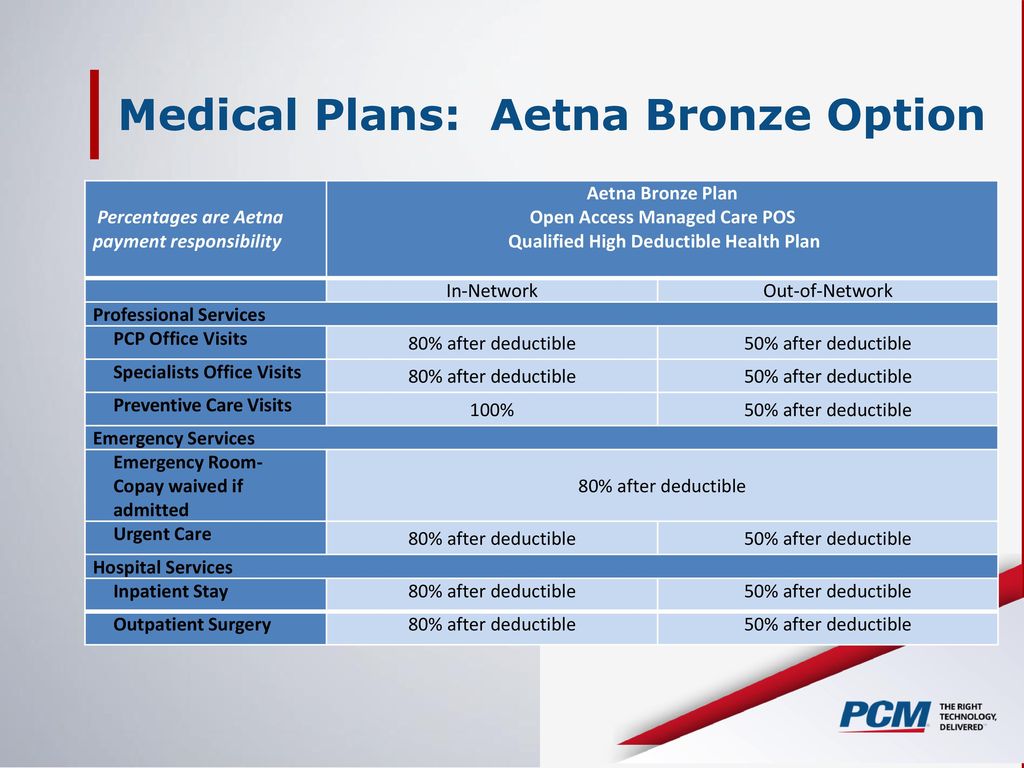

Aetna emergency room deductible. A deductible is the amount you pay for coverage services before your health plan kicks in. If your emergency room visit requires you to be admitted for inpatient care your medicare part a benefits would kick in but are subject to the part a deductible and coinsurance. Same benefits apply once calendar year deductible is paid. The partnership provides consumers with timely access to dental care that is available 24 7 365 days a year in the event of an emergency with virtual exams covered at 100 with no deductibles copays paperwork or claims to file through june 30.

When you have no choice we will pay the bill as if you got care in network. When you need emergency care for example due to a heart attack or car accident go to any doctor walk in clinic urgent care center or emergency room. They include but are not limited to. When seeking emergency care please note that.

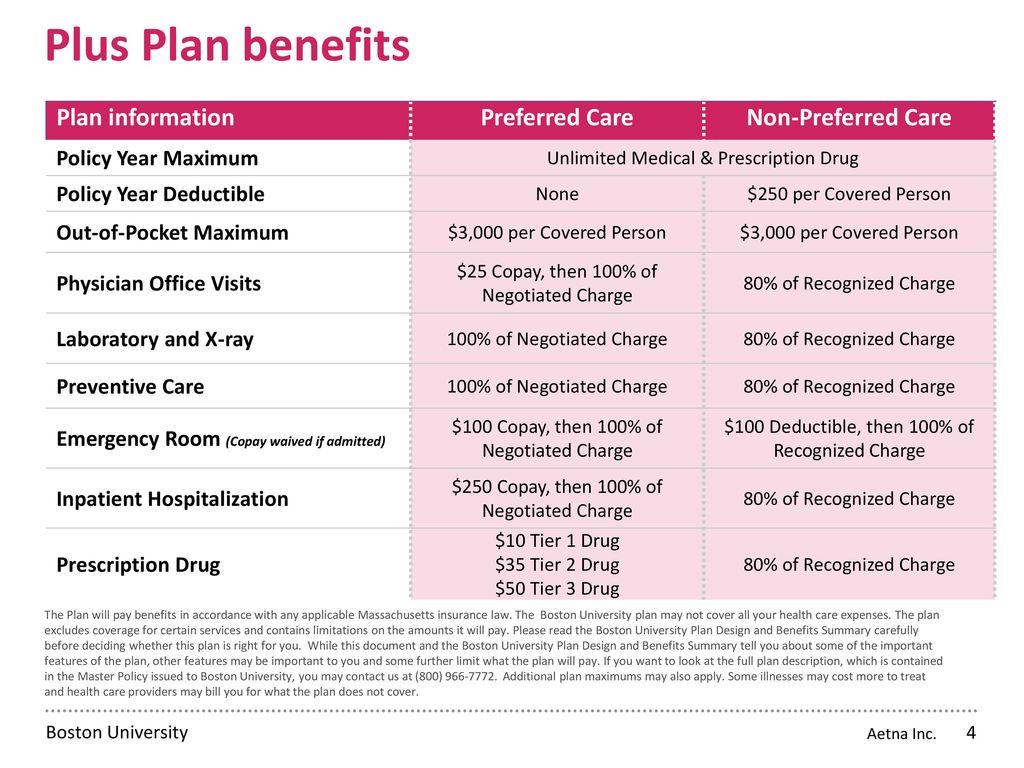

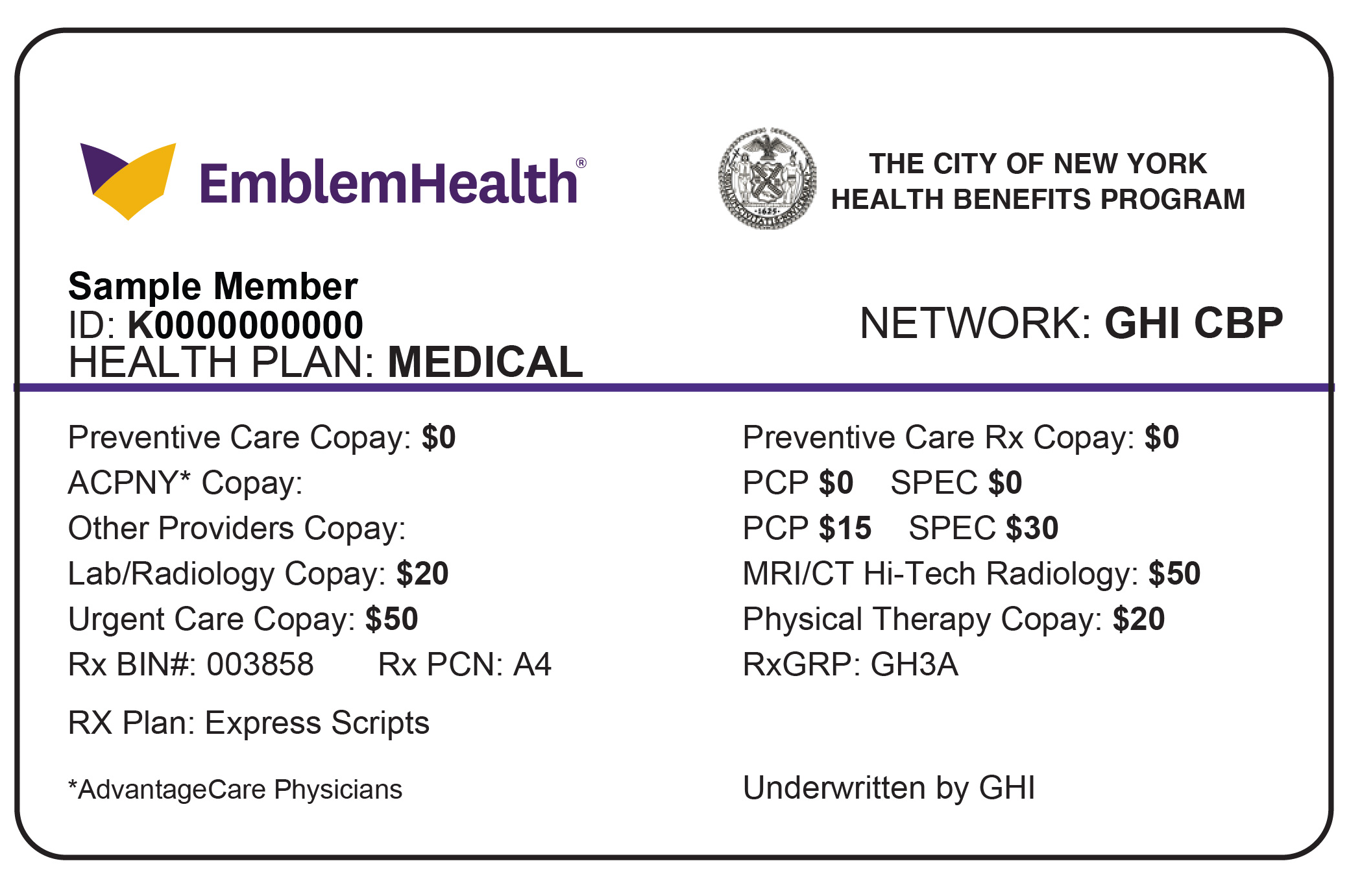

You pay your plan s copayments coinsurance and deductibles for your network level of benefits. Aetna offers health insurance as well as dental vision and other plans to meet the needs of individuals and families employers health care providers and insurance agents brokers. The path to healthy starts here. 20 coinsurance 20 coinsurance.

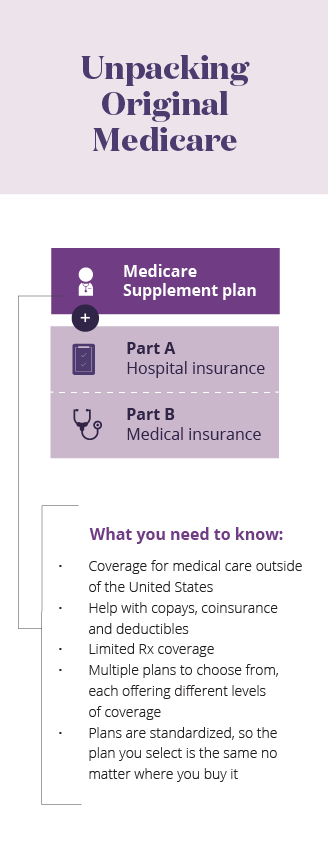

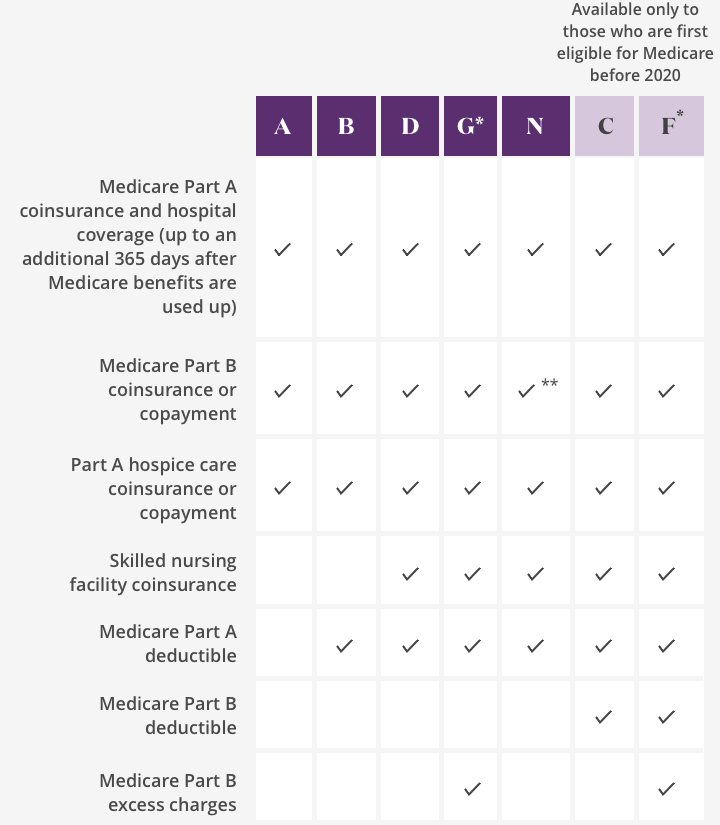

You are responsible for any emergency room copay. It s like when friends in a carpool cover a portion of the gas and you the driver also pay a portion. Plan n requires a 20 copayment for office visits and a 50 copayment for emergency room visits. Emergency and observation services including overnight stays in a hospital.

After you meet your deductible you pay a percentage of health care expenses known as coinsurance. Most er services are considered hospital outpatient services which are covered by medicare part b. Emergency room visit at hospital 250 copayment per visit waived if admitted ambulance 100 copayment per transport urgent care 75 copayment per visit if the use of a participating or non participating hospital emergency room is not due to an emergency medical condition for a condition covered. The following plans include part a hospice care coinsurance or copayment.

20 coinsurance in network 90 coinsurance out of network for non emergency tran sport. 150 copay visit deductible doesn t apply 150 copay visit deductible. Copayments do not count toward the annual part b deductible.